vehicle sales tax san antonio texas

Albert Uresti MPA Physical Address. You can calculate out-of-state rates tag title and other fees.

Used Car Dealer In San Antonio Tx 78238 Drivetime

Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas.

. The average cumulative sales tax rate in San Antonio Texas is 822. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. County tax assessor-collector offices provide most vehicle title and registration services including.

Investigating and Resolving Texas Title Errors. San Antonios current sales tax rate is 8250 and is distributed as follows. Some dealerships may charge a documentary fee of 125 dollars.

Texas collects a 625 state sales tax rate on the purchase of all. Rates will vary and will be posted upon arrival. 4 rows The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125.

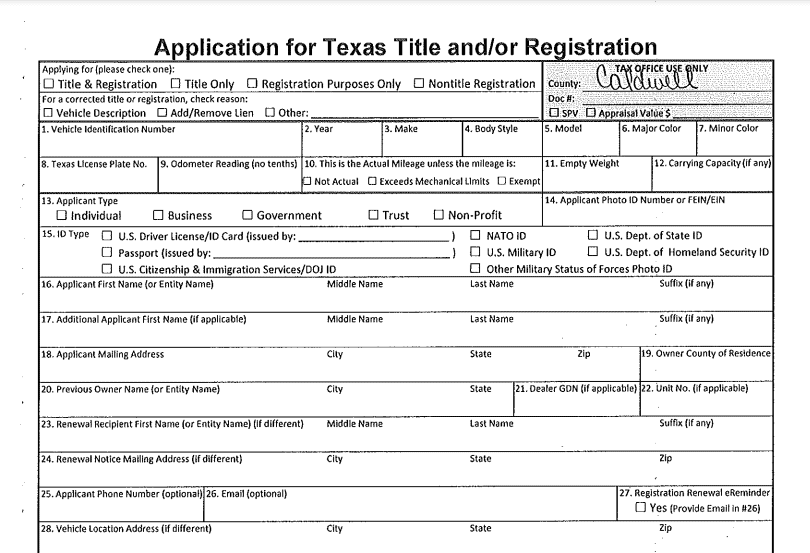

The latest sales tax rate for San Antonio TX. A motor vehicle sale includes installment and credit sales and exchanges for property services or money. Title History Inquiries.

2018 rates included for use while preparing your income tax. Jurors parking at the garage. 1000 City of San Antonio.

Rates will vary and will be posted upon arrival. PersonDepartment 100 W. 4 rows San Antonio TX Sales Tax Rate.

If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle. Monday - Friday 745 am - 430 pm Central Time. Send your renewal form and a photocopy of proof of insurance to.

City of San Antonio Property Taxes are billed and collected by the Bexar County. Registration Renewals License Plates and Registration Stickers. Jurors parking at the garage.

San Antonio has parts of it located within Bexar. Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas. What is the sales tax rate in San Antonio Texas.

Box 839950 San Antonio TX 78283-3950 Telephone. San Antonio TX 78283-3966. The current total local sales tax rate in San Antonio.

Reach Out to QQ Online Portal and subscribe for the most efficient method of complying with all the new nexus interstate tax laws. The minimum combined 2022 sales tax rate for San Antonio Texas is. This is the total of state county and city sales tax rates.

233 N Pecos La Trinidad San Antonio TX 78207 Mailing Address. Vehicle registrations may also be renewed by mail. You can locate your county tax office with the Find Your Local Tax Office resource.

0125 dedicated to the City of San Antonio Ready to Work Program. Bexar County Tax Assessor-Collector Office. This rate includes any state county city and local sales taxes.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. In addition to taxes car purchases in Texas may be. This includes the rates on the state county city and special levels.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive. When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage.

Aw Texas Plant Opens In Cibolo Employs 400 With Plans To Expand

Freedom Chevrolet Chevrolet Dealer San Antonio Tx

Used Cars For Sale In San Antonio Tx Under 10 000 Cars Com

San Antonians Can Now Take A Larger Exemption On Their Property Taxes For Homesteads Seniors And Disabilities Tpr

Do I Keep My Plates When Selling A Car In Texas Motors On Wheels

Used Cars For Sale In San Antonio Tx Under 6 000 Cars Com

Texas Car Sales Tax Everything You Need To Know

Cars For Sale In San Antonio Tx Cowboy S Auto Sales

Texas Used Car Sales Tax And Fees

How To Register Your Car In Texas A Helpful Guide

Vehicle Registration Renewal Bexar County Tx Official Website

Texas Auto Title Kirby Title And Registration Company In San Antonio

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price