pa inheritance tax exemption

PA Department of Revenue Subject Inheritance Tax Exemptions for Agricultural Commodities Agricultural Conservation Easements Agricultural Reserves Agricultural Use. Attach the following information.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Ancestors lineal decedents spouses or estates of any of those persons also qualify.

. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code. The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or income to take up to 3500 from the decedents bank account until the estate account is opened. The most important exemption is for property that is owned jointly by a husband and wife.

REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. Copy of the deed. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021.

Federal Estate Tax purposes regard-less of the form of payment. Any property transferred to or for the benefit of the decedents siblings and lineal descendants may qualify provided all other applicable statutory requirements are satisfied. The purpose of the law was to preserve farmland from being sold following the death of the owner.

For decedents dying after Jan. REV-720 -- Inheritance Tax General Information. Since the federal exclusion was elimi-.

This law specifically defines how this inheritance tax exemption is applied and defines what a qualified family business means. Each exemption has its own requirements and the real estate is reported on a timely filed inheritance tax return. The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State.

Summary of PA Inheritance Tax PA is one of the few states that still has an inheritance tax NJ also has inheritance tax Most states adopted a pick-up tax tied to the federal state death tax credit When credit was changed to a deduction many states decoupled their state tax from federal rules NY has a 5250000 exemption in. There are also certain situations that may exempt someone from inheritance tax. Act 85 of 2012 created two exemptions the business of agriculture 72 PS.

In basic terms assets were exempt from tax only if the spouses owned them jointly. Pennsylvania Inheritance Tax Safe Deposit Boxes. Business of Agriculture Exemption 72 PS.

If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption. Charitable religious and educational organizations are also usually exempt from paying inheritance tax. If the deceaseds farm falls into a specific category the land can pass free of the Pennsylvania Inheritance Tax.

The federal gift tax has an exemption of 15000 per recipient per year for 2021 and 16000 in 2022. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. Pennsylvanias Governor signed a new law which went into effect on July 9 2013.

Copy of the county assessment card. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural culture and family farms intact for future generations. Pennsylvania also allows a family exemption deduc- tion of 3500 paid to a member of the immediate family living with the decedent at the time of death.

That is in the past the exemption didnt apply if the property was owned solely by one of the spouses. The farmland must transfer from the deceased to one of the deceaseds family The farmland must continue to be devoted to agricultural business for at least 7. This law is significant in the area of PA Wills and Trusts as it allows an inheritance tax exemption for the transfer of qualified family-owned businesses.

Family Farm Exemption. An exemption from inheritance tax under 72 PS. Inheritance of Farm Exempt from Pennsylvania Inheritance Tax.

Pennsylvanias Inheritance Tax is levied on assets passing to beneficiaries when a person passes away. If the Joint Account was made within one year of death it is fully taxable. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. 29 1995 the family exemption is 3500. Secondly certain property is exempt from the tax altogether.

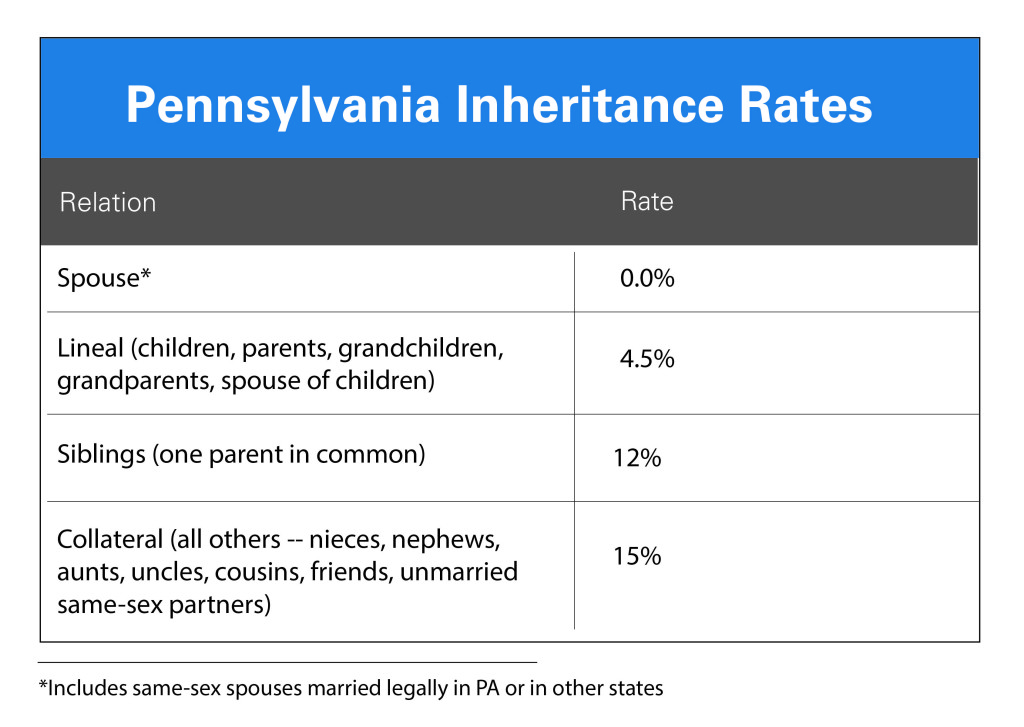

Pennsylvania Inheritance Tax is 12 on property passing to siblings and 15 to everyone else. Claiming the family exemption for inheritance tax. At death a persons assets are frozen until the Executor goes to the Register of Wills with the.

There are limited exceptions for benefi ts that had commenced prior to 1985. 9111s and farmland - other 72 PS. Written statement explaining in detail how the real estate qualifies for the claimed exemption.

What is the family exemption for inheritance tax. REV-1381 -- StocksBonds Inventory. In order to qualify for the tax exemption certain qualifications need to be met.

Who qualifies for the farmland other exemption from inheritance tax. How many inheritance tax exemptions are available pursuant to Act 85 of 2012. There is no gift tax in Pennsylvania.

9111s or s1. After July 1 2013. For example if a husband owned a bank.

Under a new Pennsylvania law there will no longer be an inheritance tax on farms owned by decedents who passed away after June 30 2012. REV-714 -- Register of Wills Monthly Report. Proceeds from qualifi ed employee benefi t plans that are exempt for Federal Estate Tax purposes are exempt from the Pennsylvania Inheritance Tax.

In Pennsylvania for instance if a parent inherits property from a child age 21 or younger the inheritance tax rate is 0. Therefore if you and your spouse own all of your property jointly upon death of the first spouse there will be no Pennsylvania inheritance tax. Joint accounts which were made joint more than one year before death are taxed at one half of value.

Traditionally the Pennsylvania inheritance tax had a very narrow exemption for transfers between the spouses. Life insurance is exempt from PA inheritance tax and federal income tax.

Florida Estate Tax Rules On Estate Inheritance Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Naming A Trust As Beneficiary Of A Retirement Plan Retirement Planning How To Plan Estate Planning

Estate Gift Tax Considerations

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Inheritance Tax What It Is And What You Need To Know

2020 Estate And Gift Taxes Offit Kurman

Estate Tax Vs Inheritance Tax What S The Big Difference Ageras

State Estate And Inheritance Taxes

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

Federal Gift Tax Vs California Inheritance Tax

Recent Changes To Estate Tax Law What S New For 2019

Calculating Inheritance Tax Laws Com

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit